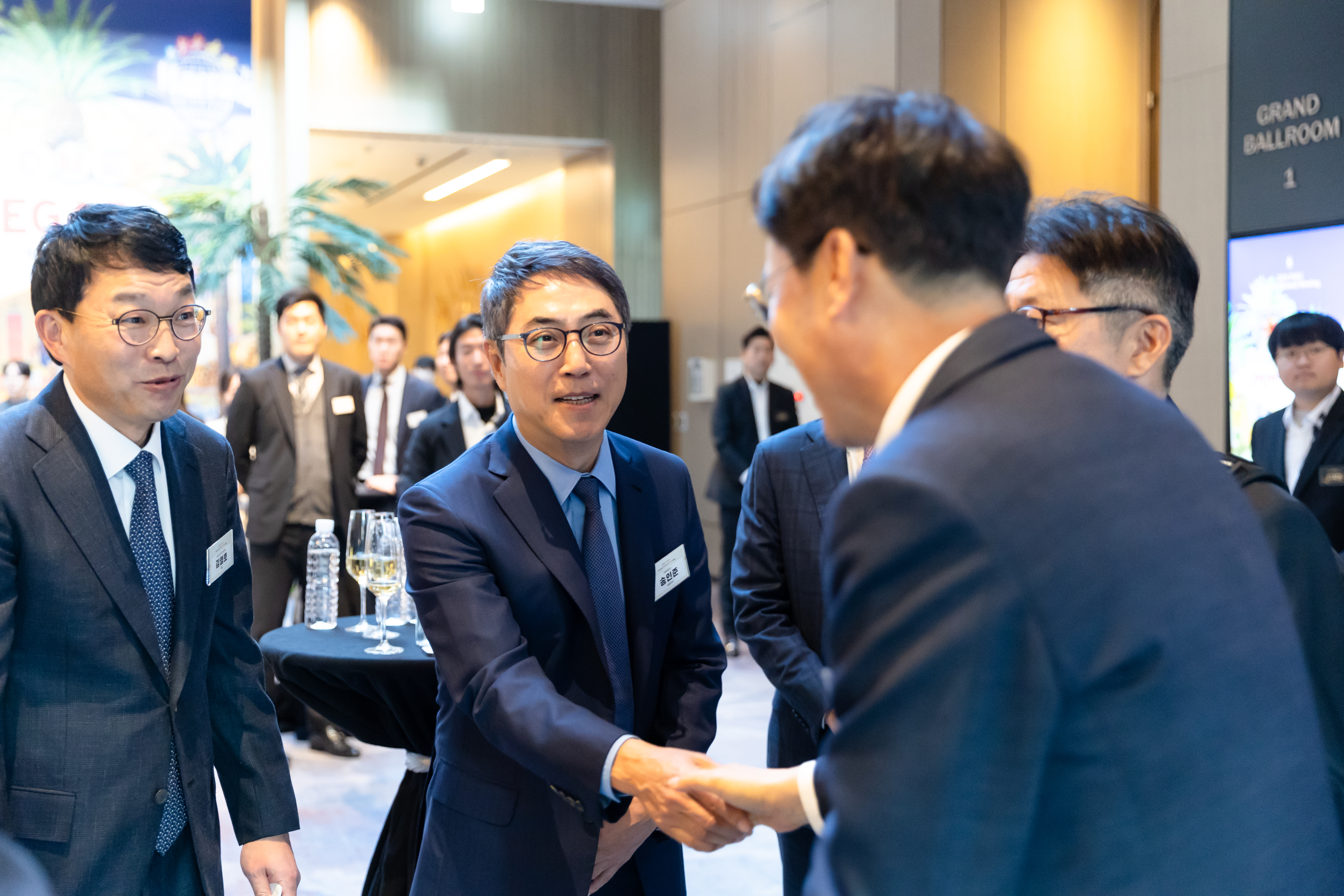

- We continue to create significant value for our portfolio companies.

- IMM Holdings, Inc., since its inception in 2006, is doing our best to provide diverse investment opportunities with different risk-return profile throughout its subsidiaries, IMM Private Equity and IMM Credit & Solutions.

Company

We constantly seek profit for our investors, growth for our portfolio companies,

and pride for members of the IMM family.

Optimal investment

Optimal investment